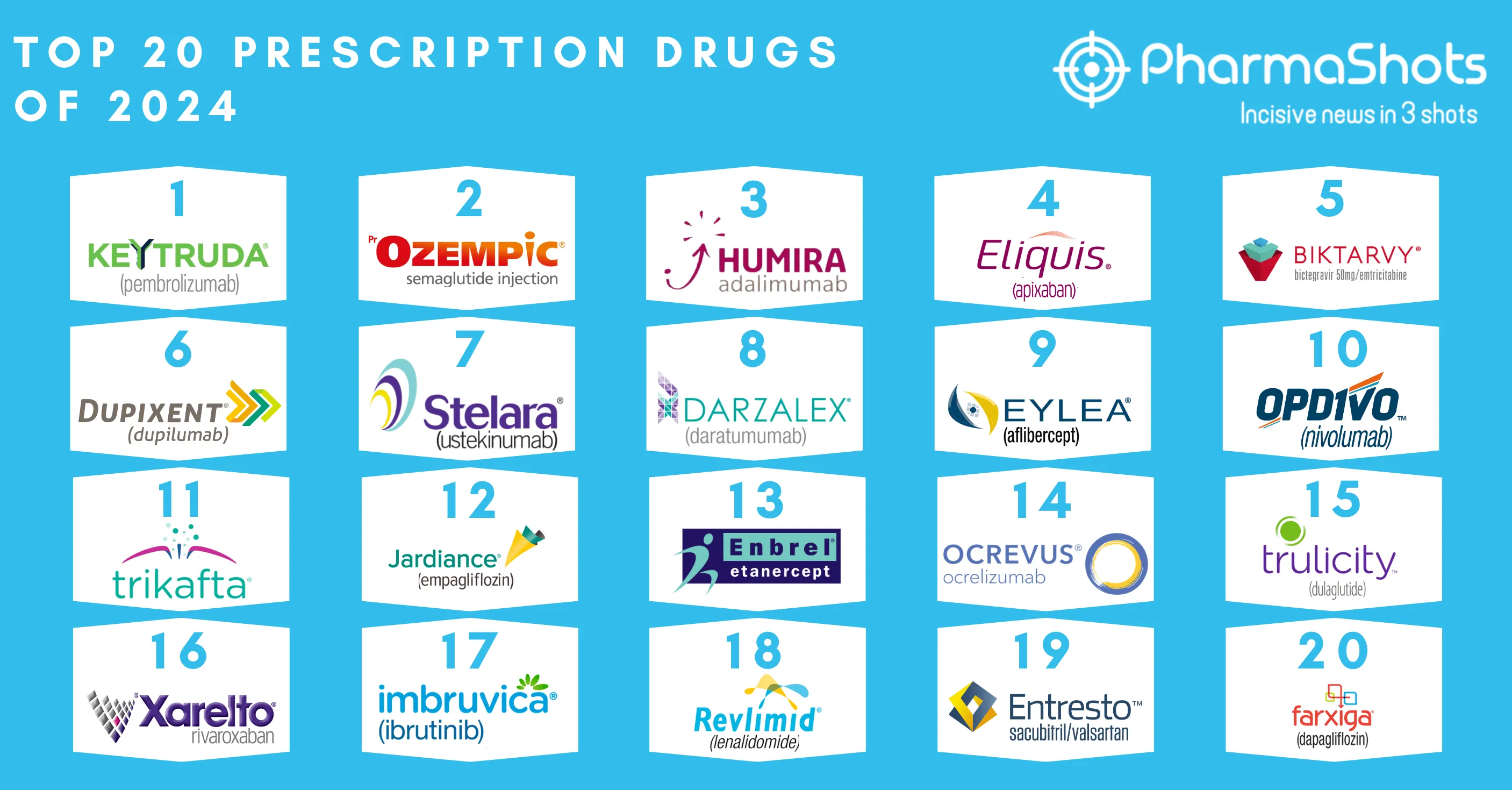

Top 20 Prescription Drugs of 2024

Shots:

- Driven by an endless pursuit of innovation, the biopharma industry is working tirelessly to bring new-age therapies to patients with serious health conditions and lifestyle-influenced diseases

- In 2023, the global prescription drug market size was valued at $1162.61B and is anticipated to reach $2151.63B by 2032 registering a CAGR of 7.1 %. Keytruda ranks 1st in our list with a reported revenue of $25.01B followed by Ozempic/Wegovy/Rybelsus and Humira with $21.58B and $14.4B sales globally

- PharmaShots brings a succinct report on the Top 20 Prescription Drugs based on 2023 revenue

|

Note: Columns 1 and 2 represent ranks and drugs, while Columns 3, 4, and 5 showcase the total revenue of 2022, the total revenue of 2023, and the percentage change.

20. Farxiga/Forxiga

Proprietary Name: Farxiga/Forxiga

Non-Proprietary Name: Dapagliflozin

Company: AstraZeneca

First Approved: US (Jan 8, 2014), EU (Nov 11, 2012)

Total Revenue: $5.96B

Indications Approved: Type 2 Diabetes, Heart Failure, Chronic Kidney Disease

- Marketed as Farxiga in the US and Forxiga in the EU, dapagliflozin is an oral tablet approved for the treatment of Type 2 Diabetes, Heart Failure, and Chronic Kidney Disease

- Farxiga reversibly inhibits sodium-glucose co-transporter 2 (SGLT-2) in the renal proximal tubule, which decreases glucose reabsorption and increases urinary glucose excretion. In 2023, the sales of Farxiga/Forxiga increased by 36.11% as compared to 2022, due to its recent launches in HF and CKD

- In Feb’23, the EMA approved Forxiga for the treatment of symptomatic chronic heart failure

19. Entresto

Proprietary Name: Entresto

Non-Proprietary Name: Sacubitril/Valsartan

Company: Novartis

First Approved: US (Jul 7, 2015), EU (Nov 19, 2015)

Total Revenue: $6.03B

Indications Approved: Adult Heart Failure, Pediatric Heart Failure

- Entresto is a combination medicine that contains sacubitril/valsartan, also known as angiotensin receptor-neprilysin inhibitor (ARNi) approved for the treatment of Adult Heart Failure and Pediatric Heart Failure

- Entresto functions by inhibiting neprilysin (neutral endopeptidase; NEP) through LBQ657, the active metabolite of the prodrug sacubitril, and blocks the angiotensin II type-1 (AT1) receptor through valsartan. In 2023, Entresto's overall revenue increased by 29.95% as compared to 2022, mainly driven by higher sales in Europe and the US

- In Mar’23, Novartis’ Entresto received EMA’s positive CHMP opinion for pediatric heart failure

18. Revlimid

Proprietary Name: Revlimid

Non-Proprietary Name: Lenalidomide

Company: BMS & BeiGene

First Approved: US (Dec 27, 2005), EU (Jun 14, 2007)

Total Revenue: $6.17B

Indications Approved: Myelodysplastic Syndrome, Multiple Myeloma, Mantle Cell Lymphoma, Follicular Lymphoma, Marginal Zone Lymphoma

- Revlimid is an orally approved thalidomide analogue prescribed for the treatment of patients with certain cancers and serious conditions affecting blood cells and bone marrow, including Multiple Myeloma, Myelodysplastic Syndromes, and Mantle Cell Lymphoma

- Lenalidomide functions as an analogue of thalidomide with immunomodulatory, antiangiogenic, and antineoplastic properties. In 2023, Revlimid showed a 38.62% decrease in its sales revenue as compared to 2022, mainly driven by generic erosion

- In Feb’23, Sun Pharma reported the US FDA's approval for its generic Lenalidomide capsules

17. Imbruvica

Proprietary Name: Imbruvica

Non-Proprietary Name: Ibrutinib

Company: Johnson & Johnson & AbbVie

First Approved: US (Nov 13, 2013), EU (Oct 21, 2014)

Total Revenue: $6.86B

Indications Approved: Chronic Lymphocytic Leukemia, Waldenström Macroglobulinemia, Graft-Versus-Host Disease, Lymphoma

- A kinase inhibitor, Imbruvica, is approved for the treatment of Chronic Lymphocytic Leukemia, Waldenström Macroglobulinemia, Chronic Graft-Versus-Host Disease, and Lymphoma

- It is a small molecule inhibitor of Bruton’s tyrosine kinase (BTK) as it forms a covalent bond with a cysteine residue in the BTK active site and inhibits BTK enzymatic activity. Imbruvica’s 2023 revenue declined by 17.86% as compared to 2022, due to low reported sales of Imbruvica in the market

- In Apr’23, J&J voluntarily withdrew the U.S. indications for IMBRUVICA for the treatment of patients with mantle cell lymphoma

16. Xarelto

Proprietary Name: Xarelto

Non-Proprietary Name: Rivaroxaban

Company: Johnson & Johnson & Bayer

First Approved: US (Jul 01, 2011), EU (Sep 30, 2008)

Total Revenue: $6.87B

Indications Approved: Deep Vein Thrombosis Prophylaxis after Knee Replacement Surgery, Deep Vein Thrombosis Prophylaxis after Hip Replacement Surgery, Prevention of Thromboembolism in Atrial Fibrillation, Coronary Artery Disease, Peripheral Arterial Disease, Deep Vein Thrombosis, Pulmonary Embolism, Venous Thromboembolism

- A factor Xa inhibitor, Xarelto, is an anticoagulant medication used to treat and prevent blood clots. Xarelto is indicated for the treatment of Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE)

- Though it has no direct effect on platelet aggregation, it indirectly inhibits platelet aggregation induced by thrombin. In 2023, the sales of Xarelto decreased by 5.82% compared to 2022. The decline in sales was driven by unfavorable patient mix and access changes

- In Nov’23, J&J reported the benefits of Xarelto + Aspirin vs. Standard of Care (Aspirin) from its P-III VOYAGER PAD clinical study

15. Trulicity

Proprietary Name: Trulicity

Non-Proprietary Name: Dulaglutide

Company: Eli Lilly

First Approved: US (Sep 18, 2014), EU (Nov 21, 2014)

Total Revenue: $7.13B

Indications Approved: Type 2 Diabetes Mellitus, Cardiovascular Risk Reduction

- Trulicity is a glucagon-like peptide-1 (GLP-1) receptor agonist indicated for the treatment of Type 2 Diabetes and Cardiovascular Risk Reduction

- Trulicity activates the GLP-1 receptor, a membrane-bound cell-surface receptor coupled to adenylyl cyclase in pancreatic beta cells and increases intracellular cyclic AMP (cAMP) in beta cells leading to glucose-dependent insulin release. Trulicity’s total revenue in 2023 decreased by 4.12% as compared to 2022, majorly driven by lower realized prices

- In 2023, Europe faced a shortage of Trulicity due to higher demands and prescriptions to non-diabetic patients seeking to lose weight

14. Ocrevus

Proprietary Name: Ocrevus

Non-Proprietary Name: Ocrelizumab

Company: Roche

First Approved: US (Mar 28, 2017), EU (Jan 08, 2018)

Total Revenue: $7.58B

Indications Approved: Multiple Sclerosis

- Ocrevus is a humanized mAb used in the treatment of both relapsing and primary progressive forms of Multiple Sclerosis. It targets CD20-positive B cells, an immune cell type that has a significant contribution to myelin and axonal damage

- Ocrevus triggers antibody-dependent cellular cytolysis and complement-mediated lysis. In 2023, Ocrevus revenue went up by 15.99% as compared to 2022. The increased sales of Ocrevus were led by the increase in sales by new and returning patients

- In Oct’23, Roche reported data after 10 years of treatment OCREVUS showed 77% of individuals with relapsing multiple sclerosis experienced no disability progression, while 92% were able to walk unaided

13. Skyrizi

Proprietary Name: Skyrizi

Non-Proprietary Name: Risankizumab

Company: AbbVie

First Approved: US (Apr 23, 2019), EU (Apr 26, 2019)

Total Revenue: $7.76B

Indications Approved: Plaque Psoriasis, Psoriatic Arthritis, Crohn’s Disease, Ulcerative Colitis

- Skyrizi is a humanized mAb, approved in the form of an SC or IV injection to treat Plaque Psoriasis, Psoriatic Arthritis, Crohn’s Disease, and Ulcerative Colitis

- Skyrizi is a humanized IgG1 monoclonal antibody that acts as an interleukin-23 antagonist. It selectively binds to the p19 subunit of IL-23, inhibiting its interaction with the IL-23 receptor. In 2023, Skyrizi's revenue increased by 50.30% as compared to 2022, one of the reasons for growth was an indication of expansion

- In Oct’23, AbbVie's Skyrizi met all its 1EPs and 2EPs vs Stelara in a head-to-head clinical study for the treatment of Crohn's Disease

12. Jardiance

Proprietary Name: Jardiance

Non-Proprietary Name: Empagliflozin

Company: Boehringer Ingelheim

First Approved: US (Aug 1, 2014), EU (May 22, 2014)

Total Revenue: $8.14B

Indications Approved: Type-2 Diabetes Mellitus, Chronic Heart Failure, Chronic Kidney Disease

- Jardiance is an oral tablet approved to treat Type-2 Diabetes, Chronic Heart Failure, and Chronic Kidney Disease

- Jardiance inhibits the sodium-glucose co-transporter-2 (SGLT-2) in the kidney's proximal tubules, leading to decreased renal glucose reabsorption and increased urinary glucose excretion. In 2023, Jardiance showed an increase of 30.85% in its revenue as compared to 2022, due to its approval of a new indication

- In Jul’23, Jardiance was approved in Europe to treat adults with chronic kidney disease

11. Trikafta/Kaftrio

Proprietary Name: Combination of Trikafta/Kaftrio

Non-Proprietary Name: Elexacaftor/tezacaftor/ivacaftor

Company: Vertex

First Approved: US (Oct 21, 2019), EU (Aug 21, 2020)

Total Revenue: $8.94B

Indications Approved: Cystic Fibrosis

- Marketed as Trikafta in the US and Kaftrio in the EU, it is an oral drug developed through a combination of ivacaftor, tezacaftor, and elexacaftor, approved for the treatment of Cystic Fibrosis

- Trikafta/Kaftrio enhances chloride and sodium ion transport, correcting fluid imbalances in cystic fibrosis. Its effectiveness varies based on the patient's specific CF mutations. In 2023, Trikafta/Kaftrio sales increased by 16.36% as compared to 2022 owing to the label extension in younger age groups

- In Apr’23, Vertex reported the US FDA approval for Trikafta in children with cystic fibrosis aged 2-5 with certain mutations

10. Opdivo

Proprietary Name: Opdivo

Non-Proprietary Name: Nivolumab

Company: Bristol-Myers Squibb

First Approved: US (Dec 22, 2014), EU (Jun 19, 2015)

Total Revenue: $9B

Indications Approved: Melanoma, Non-Small Cell Lung Cancer, Malignant Pleural Mesothelioma, Renal Cell Carcinoma, Classical Hodgkin Lymphoma, Squamous Cell Carcinoma of the Head and Neck, Urothelial Carcinoma, Colorectal Cancer, Hepatocellular Carcinoma, Esophageal CancerGastric Cancer, Gastroesophageal Junction Cancer, and Esophageal Adenocarcinoma

- Opdivo is a human immunoglobulin G4 (IgG4) mAb indicated for the treatment of Melanoma, NSCLC Malignant Pleural Mesothelioma, Renal Cell Carcinoma, Classical Hodgkin Lymphoma, Head and Neck Cancer, Urothelial Carcinoma, etc.

- Opdivo binds to the PD-1 receptor and blocks its interaction with PD-L1 and PD-L2, releasing PD-1 pathway-mediated inhibition of the immune response, resulting in decreased tumor growth. Opdivo’s total sales in 2023 increased by 9.21% as compared to 2022, due to higher demands in the US

- In Oct’23, the US FDA approved Opdivo as adjuvant treatment for patients with completely resected stage IIB or stage IIC melanoma

9. Eylea/Eylea HD

Proprietary Name: Eylea/Eylea HD

Non-Proprietary Name: Aflibercept

Company: Regeneron Pharmaceuticals, Bayer

First Approved: Eylea [US (Nov 18, 2011), EU (Nov 21, 2012)], Eylea HD [US (Aug 18, 2023)]

Total Revenue: $9.38B

Indications Approved: Neovascular (Wet) Age-Related Macular Degeneration, Diabetic Macular Oedema, Retinopathy of Prematurity, Diabetic Retinopathy

- Approved in the form of an IV injection, Eylea is a vascular endothelial growth factor (VEGF) inhibitor indicated for the treatment of Neovascular (Wet) Age-Related Macular Degeneration, Diabetic Macular Edema, Diabetic Retinopathy, and Retinopathy of Prematurity

- Eylea acts as a soluble decoy receptor that binds VEGF-A and PIGF thereby inhibiting the binding and activation of these cognate VEGF receptors. 2023 sales of Eylea decreased by 2.76% as compared to 2022. The dip in Eylea's sales can be attributed to lower sales in the US

- In Aug’23, Eylea HD (8mg) injection was approved by the US FDA approval for the treatment of wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and diabetic retinopathy (DR)

8. Darzalex

Proprietary Name: Darzalex

Non-Proprietary Name: Daratumumab

Company: Johnson & Johnson

First Approved: US (Nov 16, 2015), EU (May 20, 2016)

Total Revenue: $9.74B

Indications Approved: Multiple Myeloma

- A human anti-CD38 monoclonal antibody, Darzalex (daratumumab) is prescribed in the form of an IV infusion to treat Multiple Myeloma

- Daratumumab binds to CD38, leading to the cell's apoptosis through antibody-dependent cellular cytotoxicity, complement-dependent toxicity, inhibition of mitochondrial transfer, or antibody-dependent cellular phagocytosis. In 2023, Darzalex’s revenue boosted by 22.15% vs 2022. The rise in the product’s total sales in 2023 was attributed to strong market growth and share gains in all regions

- In Nov’23, J&J presented two presentations on Darzalex in two different studies at ASH 2023

7. Stelara

Proprietary Name: Stelara

Non-Proprietary Name: Ustekinumab

Company: Johnson & Johnson

First Approved: US (Sep 25, 2009), EU (Jan 15, 2009)

Total Revenue: $10.85B

Indications Approved: Plaque Psoriasis (Ps), Crohn’s Disease, Psoriatic Arthritis (PsA), Ulcerative Colitis

- Stelara is indicated for the treatment of Plaque Psoriasis, Crohn’s Disease, Psoriatic Arthritis (PsA), and Ulcerative colitis

- It is an interleukin inhibitor that blocks certain proteins in the body called IL-12 (interleukin-12) and IL-23 (interleukin-23) responsible for inflammation, swelling, and skin symptoms in these indications. Compared to 2022, Stelara’s total sales rose by 11.67% in 2023, this growth can be attributed to patient mix, market growth, and continued strength in IBD

- In Mar’23, Janssen reported Stelara's long-term data showing a safety profile in IBD and durable efficacy in ulcerative colitis

6. Dupixent

Proprietary Name: Dupixent

Non-Proprietary Name: Dupilumab

Company: Regeneron Pharmaceuticals

First Approved: US (Mar 28, 2017), EU (Sep 26, 2017)

Total Revenue: $11.82B

Indications Approved: Atopic Dermatitis, Asthma, Chronic Rhinosinusitis with Nasal Polyposis, Eosinophilic Esophagitis, Prurigo Nodularis, Chronic Obstructive Pulmonary Disease

- Dupixent is an interleukin-4 receptor alpha antagonist, administered as an SC injection. It is a mAb that is available as a single-dose pre-filled pen or a single-dose pre-filled syringe used to treat Atopic Dermatitis, Asthma, Eosinophilic Esophagitis, etc.

- Dupixent inhibits the signaling of the IL-4 and IL-13 pathways which are key drivers of type 2 inflammation. Dupixent’s 2023 revenue recorded a strong increase of 33.58% as compared to 2022, mainly due to higher sales in the US

- In Mar’23, Dupixent was approved by EMA to treat severe atopic dermatitis in children aged 6 months to 5 years old

5. Biktarvy

Proprietary Name: Biktarvy

Non-Proprietary Name: Combination of Bictegravir, Emtricitabine, and Tenofovir Alafenamide

Company: Gilead Sciences

First Approved: US (Feb 07, 2018), EU (Jun 21, 2018)

Total Revenue: $11.85B

Indications Approved: HIV Infection

- Biktarvy is an antiviral agent developed through a combination of bictegravir (an HIV-1 integrase strand transfer inhibitor), emtricitabine, and tenofovir alafenamide to treat HIV Infection

- The three drugs work together to block the binding site of the HIV integrase and prevent the strand transfer activity and integration of the provirus into the host genome. In 2023, Biktarvy’s total sales boosted by 14.05% as compared to 2022, owing to high demand for the product

- In Oct’23, Gilead Sciences reported long-term real-world data from its BICSTaR study highlighting the safety and efficacy profile of Biktarvy

4. Eliquis

Proprietary Name: Eliquis

Non-Proprietary Name: Apixaban

Company: BMS, Pfizer

First Approved: US (Dec 28, 2012), EU (May 18, 2011)

Total Revenue: $12.2B

Indications Approved: Prevention of Thromboembolism in Atrial Fibrillation, Deep Vein Thrombosis Prophylaxis after Knee Replacement Surgery, Deep Vein Thrombosis Prophylaxis after Hip Replacement Surgery

- Eliquis is a factor Xa inhibitor prescribed in an oral form to lower the risk of Stroke or blood clot in patients with Atrial Fibrillation

- Eliquis directly inhibits factor Xa (FXa), an enzyme that catalyzes the conversion of prothrombin to thrombin. The sales of Eliquis in 2023 increased by 3.53% as compared to 2022, due to high demand globally

- In Aug’23, BMS reported data from a retrospective real-world data study at ESC 2023, demonstrating data for switching from Eliquis to rivaroxaban

3. Humira

Proprietary Name: Humira

Non-Proprietary Name: Adalimumab

Company: AbbVie

First Approved: US (Dec 31, 2002), EU (Sep 8, 2003)

Total Revenue: $14.4B

Indications Approved: Rheumatoid Arthritis, Juvenile Idiopathic Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, Crohn’s Disease, Ulcerative Colitis, Plaque Psoriasis, Hidradenitis Suppurativa, Uveitis

- Humira is prescribed as a subcutaneous injection to treat Rheumatoid Arthritis, Juvenile Idiopathic Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, Crohn's Disease, Ulcerative Colitis, Plaque Psoriasis, Hidradenitis Suppurativa, and Uveitis

- Humira is a tumor necrosis factor (TNF) blocker that reduces inflammation by targeting and blocking TNF-α. Humira’s 2023 revenue showed a decline of 32.17% as compared to 2022, primarily driven by direct biosimilar competition following the loss of exclusivity on January 31, 2023

- In Jan’23 Amgen launched the first Humira biosimilar Amjevita in the US

2. Ozempic/Wegovy/Rybelsus

Proprietary Name: Ozempic/Wegovy/Rybelsus

Non-Proprietary Name: Semaglutide

Company: Novo Nordisk

First Approved: Ozempic [US (Dec 05, 2017), EU (Feb 8, 2018)], Wegovy [US (Jun 4, 2021), EU (Jan 6, 2022)], Rybelsus [US (Sep 20, 2019), EU (Apr 3, 2020)]

Total Revenue: $21.58B

Indications Approved: Type 2 Diabetes Mellitus, Obesity

- Semaglutide is prescribed as a type 2 diabetes mellitus and obesity drug under the brand name Ozempic (Type 2 Diabetes Mellitus), Rybelsus (Type 2 Diabetes Mellitus), and Wegovy (Obesity/Weight Loss)

- Semaglutide enhances incretin function by activating GLP-1 receptors, promoting insulin secretion in a glucose-dependent manner, inhibiting glucagon release, and suppressing hepatic gluconeogenesis, ultimately decreasing both fasting and postprandial glucose levels. In 2023, the total sales of all brands increased by 94.69% as compared to 2022, driven by higher sales globally and Wegovy's launch in various regions

- In Mar’23, the US FDA approved Wegovy in adults with heart disease and overweight & obesity

1. Keytruda

Proprietary Name: Keytruda

Non-Proprietary Name: Pembrolizumab

Company: Merck & Co.

First Approved: US (Sep 04, 2014), EU (Jul 17, 2015)

Total Revenue: $25.01B

Indications Approved: Melanoma, Non-Small Cell Lung Cancer, Head and Neck Squamous Cell Cancer, Classical Hodgkin Lymphoma, Primary Mediastinal Large B-cell lymphoma, Endometrial Carcinoma, Tumor Mutational Burden-High (TMB-H) Cancer, Cutaneous Squamous Cell Carcinoma, Triple-Negative Breast Cancer, Gastric Cancer, Esophageal Cancer, Cervical Cancer, Hepatocellular Carcinoma, Merkel Cell Carcinoma, Renal Cell Carcinoma, Biliary Tract Cancer, etc.

- Keytruda is a PD-1 blocking antibody indicated to treat patients with Melanoma, Non-small Cell Lung Cancer, Head, Neck Squamous Cell Cancer Classical Hodgkin Lymphoma, and more

- Keytruda blocks the interaction between PD-1 and its ligands (PD-L1 and PD-L2), activating T-lymphocytes that may affect both the tumor cells and healthy cells. In 2023, Keytruda’s net sales rose by 19.45% compared to 2022 due to increased demand from new global indications and ongoing uptake in current ones

- In Dec’23, the US FDA approved an extended indication for Keytruda + Padcev for the 1L treatment of adult patients with locally advanced or metastatic urothelial carcinoma

Sources:

- Annual reports

- SEC Filings

- Press releases

- Company websites

Currency Conversion: Oanda

Note: Percentage Change in Segment Revenue is calculated on precise value in Millions

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.